RESEARCH:

Sentiment Outperforms during June Quant Sell Off

July 25, 2025

As first reported by Business Insider

Quants are getting pummeled in June

- Quant hedge funds have been losing money since the start of June.

- The causes are unclear, though execs, traders, and banks have pointed to a few factors.

- Wednesday was another rough day, as the average quant lost 0.8%, according to Goldman Sachs.

- As the fundamental investing world marvels at another potential bubble made up of meme stocks and retail traders, quant hedge funds are trying to solve a much more complex problem.

The smartest people at the smart money firms have been on a weekslong losing streak starting at the beginning of June, with firms like Qube, Two Sigma, and Point72's Cubist suffering losses over that time.

Goldman Sachs' prime brokerage unit said July was on track to be the worst month in five years and pointed to similar factors as it did earlier in the week: A momentum sell-off, crowded trades, and high volatility in certain stocks.

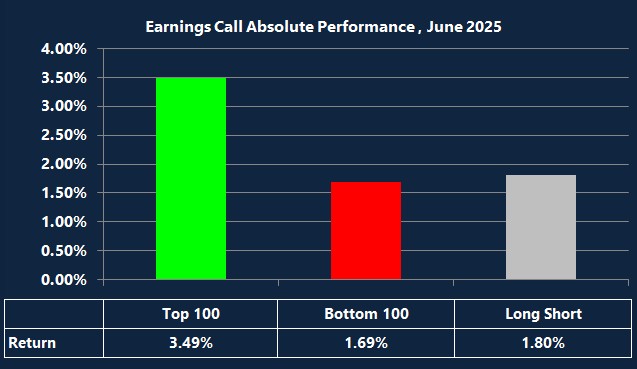

Sentiment Outperforming in June

While traditional factors may be underperforming, alternative data, particularly sentiment ,outperformed in June and YTD. Earnings Call Sentiment had a +1.80% return in June for large cap stocks while News Sentiment had a +0.46% return, supporting the orthogonality of alternative data sources.